Financial Literacy program for teens 11+

MyFinLife is an educational platform which helps teens to form healthy financial habits by:

• Identifying interests

• Discovering talents

• Discovering talents

• Setting up financial goals

• Getting first financial experience and reflecting it

• Getting first financial experience and reflecting it

first income

earn my

100% practice-based

process for better

with mentorship

method that builds

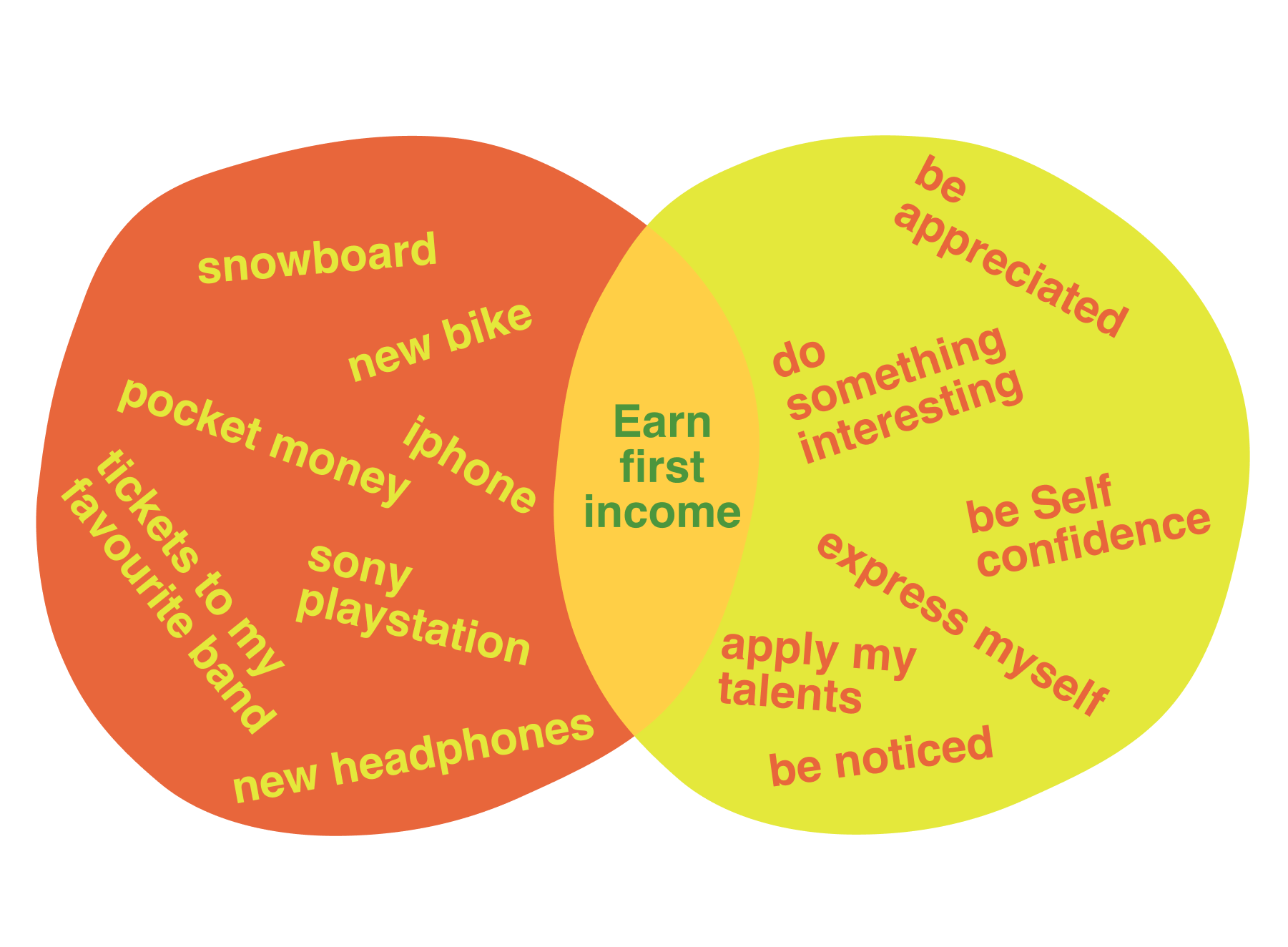

Every person needs recognition and rewards

Achievement of personal financial goals helps teens to get recognized for their skills and become prepared for adult life. They gain knowledge about how to manage money, make informed choices, be self-organized.

I want to

I need

tasks. Only real

life knowledge.

Learning-by-doing

up skills to success.

Self-paced learning

appropriation of learning materials.

Individual support

upon request.

Why it’s hard for teens to earn money

Nobody wants to offer jobs to teens, they don’t trust us

No :( I've looked at a lot of sites, but all vacancies are for adults. I don't know where to search...

I’ve found some vacancies for teens, but I don't know how to compose a good CV, без can't apply :(

Guys️, I want to sell homemade jewelry, but I don’t know how where to find clients

Hi guys, did any of you succeeded in earning?

MyFinLife — ultimate solution to improve earning skills

MyFinLife helps to obtain necessary earning skills with regard to teens' needs and preferences.

Practical Skills

• Packing your experience

• CV writing

• Networking

• Labor market research

• Negotiations

• Strategic planning

• CV writing

• Networking

• Labor market research

• Negotiations

• Strategic planning

Life Skills

• Self-reflection

• Self-organization

• Efficient communication

• Knowledge to practice

• Conscious choice

• Identifying your needs

• Ability to set goals

• Self-organization

• Efficient communication

• Knowledge to practice

• Conscious choice

• Identifying your needs

• Ability to set goals

Job search funnel

CV

How does it work?

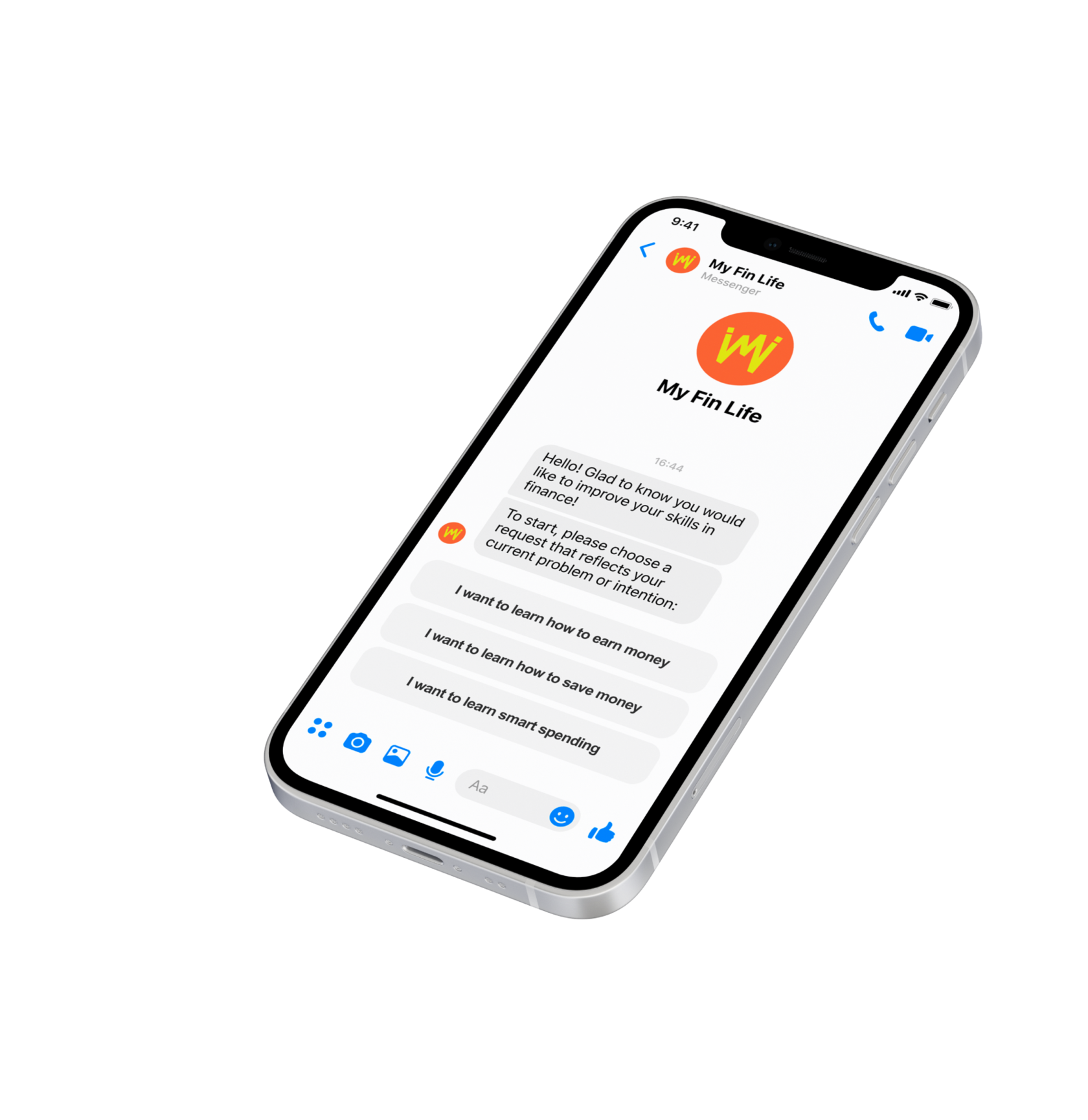

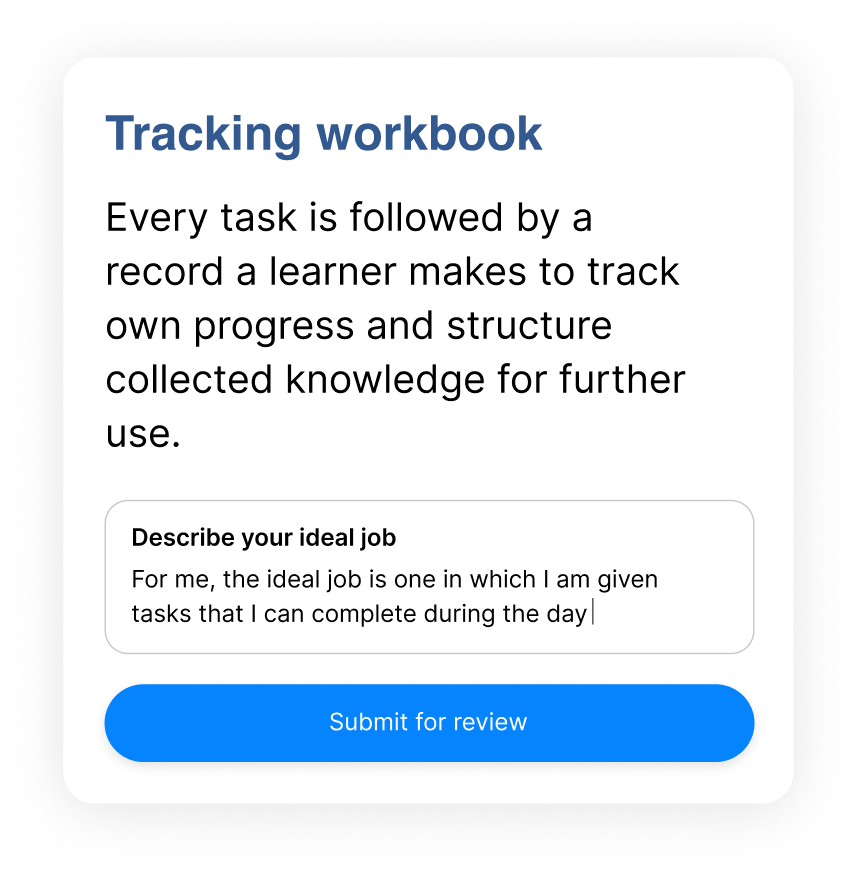

Our learning platform consists of five components which facilitate efficient learning: practical real-life tasks, personalized assignments, reflecting on them, and communicating with a mentor.

Practical learning brings practical outcomes!

Why trust us

We are a team of financial experts, pedagogy professionals and EdTech keens, who united their knowledge to make the most of personalized financial online education.

Our school in Limassol

• Mentor support

• Free study schedule

• Full access to the platform

• The first three days are free

• Free study schedule

• Full access to the platform

• The first three days are free

Application for training

70 €

discount will remain!

Submit your application now and the

We will contact you and answer all your questions.

Submit your application now and the

discount will

remain!

We will contact you and answer all your

questions.

Questions and answers

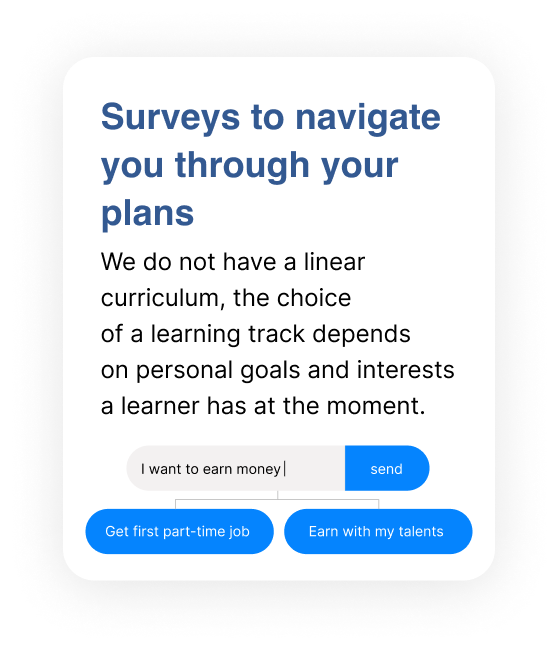

What is our approach, and why it is good?

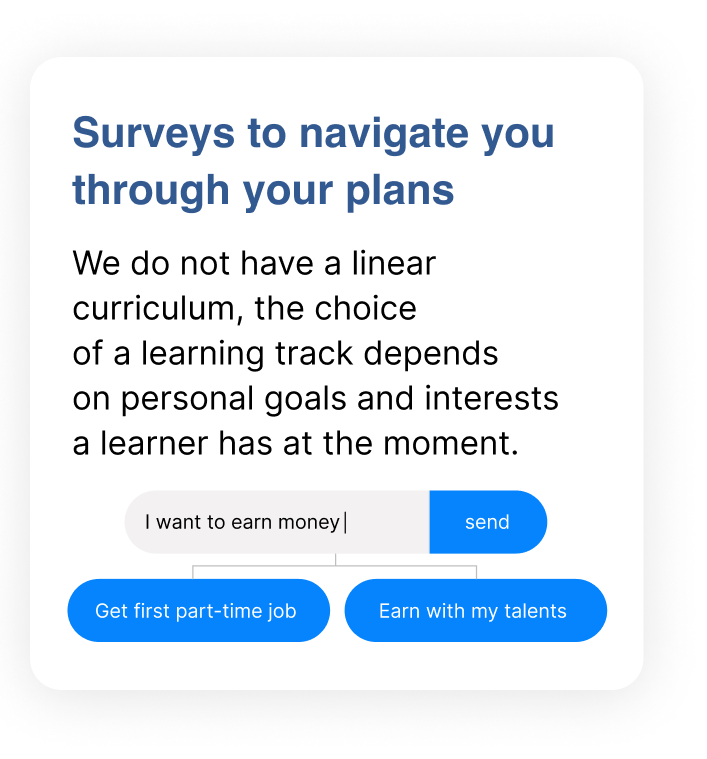

Learning is a fluid activity, and it should be personalized by definition. All of us have different interests and attitudes, talents and learning preferences. When our uniqueness is ignored or oppressed, every learning becomes ineffective, and cognitive science knows that. We, as passionate educators, know this too. That’s why we offer every child to start with own interest, proceed with safety, and end up with certain desired outcome. We offer helpers to define learning request, diverse types of tasks for different learning preferences, careful scaffolding to support persistence, reflection techniques to make this experience usable in other contexts, real-life activities to make learning not preparation for life, but the life itself. All these tools and methods make learning with us a meaningful and attractive journey, developing student’s agency and confidence.

Нow long does the training last?

Oh, we know where this question came from =) Our experience of schooling tells us that we have to go to a special place, isolate ourselves there for a certain time, perform tasks that are hardly connected to the rest of our life to achieve formal results, and that is called learning. But the learning we offer to you is different! You come to us with your own current needs and questions, being offered tasks and activities crucial to succeed in real life, which you can fulfil while at school, or having fun with friends, or talking to your parents, or reflecting your day in the evening. Of course, we have recommended deadlines for topics and tasks, which help to structure yourself. But inside deadlines you are free to plan your own schedule. We expect that about 1 hours a day would be added to your ordinary schedule when you enter our learning environment and start your financial improvement journey with us.

What should I get as learning outcomes?

First of all, you will solve your own practical tasks. If your concern, for example, is how to save more money per month, you will develop a certain strategy which suits you best and end up with visible changes in the amount you have in your pocket after a learning period. If you want to start earning, your outcome will be like: I know by what to earn, I now how to find the earning source, I have an earning plan, or even I’m already employed — it depends only on how far you are ready to go with us.

Secondly, you get related practical skills like writing CV’s or budgeting for yourself, or even labor market research, depending on what track you take.

Third, you will train a bunch of useful life skills and habits that allow you to be structured, persistent and independent not only in financial issues, but in your whole life.

And finally, you will build courage and self-confidence, as you learn in the environment where your own needs and ideas are valued and completely define your learning strategy.

Secondly, you get related practical skills like writing CV’s or budgeting for yourself, or even labor market research, depending on what track you take.

Third, you will train a bunch of useful life skills and habits that allow you to be structured, persistent and independent not only in financial issues, but in your whole life.

And finally, you will build courage and self-confidence, as you learn in the environment where your own needs and ideas are valued and completely define your learning strategy.

What is our approach, and why it is good?

Learning is a fluid activity, and it should be personalized by definition. All of us have different interests and attitudes. No student learns the same way or at the same pace. This is our personality, our identity, and this is normal. When our diversity is being ignored or oppressed, every learning becomes ineffective, and cognitive science knows that. We, as passionate educators, know this too. That’s why we offer every child to start with interest, proceed with safety, and end up with certain desired outcome. We offer helpers to define learning request, divers types of tasks for different learning preferences, careful scaffolding to support persistence, reflection techniques to make this experience usable in other contexts, real-life activities, as we know that learning is not preparation for life, it IS life. All these tools and methods make learning with us a meaningful and attractive journey, developing student’s agency and confidence.

Нow long does the training last?

Oh, we know where this question came from =) Our experience of schooling tell us that you have to go to a special place, isolate yourself there for a certain time, perform tasks that are hardly connected to the rest of your life, and that is called learning. But the learning we offer to you is different! You come here with your own real-life needs and questions, and we offer you tasks and activities to be also performed in real life, while you are at school, or having fun with friends, or talking to your parents, or reflecting your day in the evening. Of course, we have recommended deadlines for topics and tasks, which help to structure yourself. But inside deadlines you are free to plan your own schedule. So, we expect that about 1 hours a day would be added to your ordinary schedule when you enter our learning environment and start your financial improvement journey with us.

What should I get as learning outcomes?

First of all, you will solve your own practical tasks. If your concern, for example, is how to save more money per month, you will develop a certain strategy for it or with visible changes in the amount you have in your pocket at the end of a learning period. If you want to start earning, your outcome will be like: I know by what to earn, I now how to find the earning source, I have an earning plan, or even I’m already employed — it depends only on how far you are ready to go with us.

Secondly, you get related practical skills like writing CV’s or budgeting for yourself, or even labor market research, depending on what track you take.

Third, you will be trained in a bunch of useful life skills that allow you to be structured, persistent and independent not only in financial issues, but in all of life.

And finally, you will build courage and self-confidence, as you learn in the environment where your own needs and ideas are valued and completely define your learning strategy.

Secondly, you get related practical skills like writing CV’s or budgeting for yourself, or even labor market research, depending on what track you take.

Third, you will be trained in a bunch of useful life skills that allow you to be structured, persistent and independent not only in financial issues, but in all of life.

And finally, you will build courage and self-confidence, as you learn in the environment where your own needs and ideas are valued and completely define your learning strategy.

GET EXCLUSIVE OFFER

00:11:36:34